Transformation is Rare

The normal course of action for an excellent, market-leading company is to fall when market fundamentals change as a result of a significant technological, socioeconomic, or political shift.

These changes happen on different cycles in different industries, but they are inevitable. The energy business’ fundamental shift from coal to oil to renewables or whatever is next happens much more slowly than the current iterations we see in telecommunications or computing. Change is inevitable though, and the track record of industry-leading companies maintaining their position through a market shift is dismal.

The current term in vogue is to say that these companies are disrupted, which in reality simply means that they go out of business, lose power and are acquired, or fade in stature. Disruption is occurring far more quickly than ever before, as reflected by turnover in both the S&P 500 and the Fortune 500.

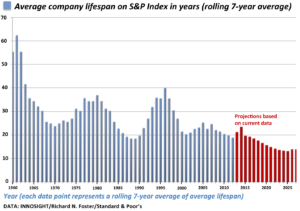

The S&P 500 is a stock market index based on the market capitalizations of 500 large publicly traded companies, selected by a committee. According to 2012 research by Professor Richard Foster of Yale University, the average lifespan of an S&P 500 company decreased from 61 years in 1958 to 25 years in 1980 to just 15 years in 2012. In 2015, 28 companies entered (and left) the S&P 500, reflecting a 5.6% churn rate. On average, an S&P 500 company is being replaced every 2 weeks.

The Forbes 500 is an annual list of the largest US corporations by total revenue. It is broader than the S&P 500 because it is not limited to publicly traded companies; it too shows similar turnover. Only 12.2% of companies on the 1955 list remain in 2015. Most of the companies from the 1955 list have been totally forgotten. Among the more interesting and less recognizable names are Amstar, Chemetron, Long-Bell Lumber, Tobin Packing, Certainteed, Royal McBee, and Joy Global.

Most companies that are disrupted when markets shift never recover. Markets are shifting as a result of technology, manufacturing, power generation, demographics, urbanization, and other technological and socioeconomic forces. Most of the brands we are familiar with today will cease to exist in the next 10-20 years, or be subordinate to new parent companies. Unfortunately, if the historical trend continues those that remain will be anomalies resulting from some combination of proactive leadership, diligent execution, and luck.

Source: INNOSIGHT / Richard N. Foster / Standard and Poor’s. Available here.

The Crush of the Now

There are a number of reasons why companies and public institutions tend to manage significant change poorly, and most are tied to structural, institutional, and economic constraints as opposed to poor individual decision-making. Leading organizations in competitive markets are good companies filled with high-performing individuals. This is an extremely broad and important discussion, but for the purpose of this piece I’d like to focus on one element – the crush of the now.

Two interesting elements came out of a 2016 survey by Innosight that included responses from 91 companies with $1B+ in annual revenue across 20 industries. The first is that 76% of respondents agree or strongly agree with this statement: “Our organization recognizes the need to transform — that is, to change our core offerings or business model — in response to rapidly changing markets and disruption.” The second is the leading responses to the question, “What is your organization’s biggest obstacle to transform in response to market change and disruption?” 40% of respondents replied that “day-to-day decisions undermine our stated strategy to change,” and 24% replied “lack of a coherent vision for the future,” which is also a challenge.

These comments confirm that leaders understand the changing nature of markets and the need to drive organizational strategy on a forward-looking basis to change their companies in response to evolving markets. It also confirms that the tactics of today often take precedence over the strategy for tomorrow.

The crush of the now can be overwhelming. The flood of information to be understood, daily decisions to be made, meetings to attend, and emails to respond to are difficult to overcome both in life and in business. And these daily requirements in most cases are not trivial. They represent real issues that need to be addressed or near-term performance will suffer.

CEOs of publicly traded companies are ultimately responsible to their shareholders, just as public officials are accountable to voters. Shareholders care about financial performance, often on a quarterly basis. CEOs who do not focus their organizations around quarterly financial performance are often replaced by those who do. Time and time again we see organizations prioritize time, people, and resources on the issues of the now at the expense of activities to shape the future. This is a completely understandable, yet imminently dangerous behavior.

Notable S&P 500 Turnover, 2010-Present

| S&P 500 Exits | S&P 500 Entrants |

|---|---|

| US Steel | |

| H.J. Heinz | Accenture |

| Safeway | PayPal |

| J.C. Penney | Activision Blizzard |

| Eastman Kodak | Netflix |

| Sears Holdings | Under Armour |

| The New York Times | Universal Health Services |

| Abercrombie & Fitch | Altera |

| Radio Shack | Seagate Technology |

| Avon Products | Trip Advisor |

Join the Catalyst Monitor

Join our community, where we push out regular insights to help maintain situational awareness on technological and socioeconomic trends.