Manufacturing Revolution

3D printing, or additive manufacturing, is a catalyst that will fundamentally disrupt the manufacturing sector and cascade through other industries, impacting shipping, logistics, transportation, infrastructure, construction, retail, and aerospace companies. This catalyst will also affect governments, national economies, and the shape of labor in both developed and developing countries.

Additive manufacturing has existed for some time and is being adopted in more and more applications. This technology traces back to stereolithography, a process that uses lasers to solidify layers of liquid polymer, developed by 3D Systems and others in 1987. The critical question is to determine the inflection point, when technological advancements and adoption rates converge to make 3D printing a mainstream process as opposed to selective or niche applications.

Currently 3D printing represents about 0.04% of the global manufacturing market and less than 1% of all goods manufactured in the United States. That percentage has risen over time, and will continue to rise into the future. Wohlers Associates, a leading expert in the field, estimates that the additive manufacturing industry has experienced a 26.2% compound annual growth rate over the past 27 years. It is predicted to reach $7.3 billion in 2016, up from $4 billion in 2013. An industry-wide survey conducted by Sculpteo in 2015 reported that 68% of respondents planned to increase spending on additive manufacturing in the next year.

Source: Gartner

Original applications generally involved prototyping, but full production applications are increasing. Top uses for 3D printing in 2015 were functional parts (29%), fit and finish components (18%), molds and tooling (10%), and visual proofs of concept (10%), demonstrating a clear transition towards more holistic applications.

This is not to suggest that a 5% adoption rate or some other single metric will activate the cascade of change we anticipate will ultimately result from additive manufacturing. The changes will impact different industries, companies, and countries based on their unique characteristics and economies. However, change is coming, and the displacement resulting from 3D printing we are already starting to see will become more prevalent over time.

Some industries have already been disrupted. One example is in the medical device industry. In 2015 98% of all hearing aids worldwide were manufactured using 3D printing. Two-thirds of manufacturers surveyed in 2015 reported that they currently use 3D printing in some capacity. This scale of disruption will spread as technology advances, costs decreases, and new applications are found.

The automotive industry currently uses 3D printing for specialized components and prototype/concept car designs. In the near future entire chassis may be printed, providing lighter-weight, more robust designs with fewer stress points. In the longer term more complex multi-part additive manufacturing techniques will allow more of the vehicle structure to be printed, which would both lower costs and increase the ability to customize smaller production runs.

Consumer products companies currently use 3D printing in limited applications for niche goods such as custom jewelry and high-end sporting goods. In the near future companies will be able to manufacture apparel and accessories using this technology, providing for a wider range of customization and personalization.

In addition to hearing aids, the medical device industry currently uses 3D printing for orthodontic implants and surgical guides. This will soon expand into stents and prosthetics that can be more easily and cost-efficiently customized on an individual basis.

The applications expand almost daily. Additive manufacturing keeps materials usage at a minimum, which is beneficial for high-cost materials (i.e., titanium landing gears). These techniques excel in complex geometries, especially those with generally low production volume. 3D printing allows for supply chain efficiencies, just-in-time subcomponent manufacturing, and mass customization — elements that are attractive for companies in all industries.

Reversing Globalization

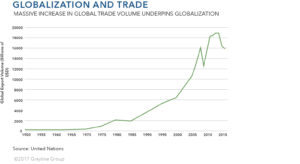

The continued development and eventual widespread adoption of 3D printing will change the shape of global trade. A significant portion of global trade is predicated on the low-end manufacturing model, where simple items (door hinges) and subcomponents for more complex products (iPhones) are produced wherever in the world they can be made most cheaply, then shipped to an assembly facility or directly to consumer markets.

Additive manufacturing will decrease the cost variance between manufacturing items locally and in faraway markets with lower labor costs. If manufacturing costs for printing an item locally or overseas are the same, the locally printed item will be cheaper because the transportation cost to get that item to the end customer or assembly factory will be lower. Businesses will manufacture goods in the lowest-cost fashion possible.

Accordingly, we expect to see more localized or regionalized manufacturing, even in developed markets. This is critically important, as the movement of goods from low production-cost markets to end-customer markets is what underpins globalization. If globalization is measured by the volume of global trade, this metric is almost certain to decline in an environment where most industrial goods can be printed locally.

Source: UNTCAD Secretariat, Clarksons Research

The Slippery Slope

We anticipate a pattern to emerge that will accelerate the adoption of 3D printing technology. Once some companies begin to onshore enough manufacturing to affect shipping patterns, shipping costs will rise.

Shipping companies are highly capital-intensive businesses. They spread their overhead costs across volume of goods transported. With a smaller base of items being transported to spread those costs over, per-unit shipping costs will be higher.

Higher per-unit shipping costs will incentivize other companies to adopt additive manufacturing technologies so they can also localize their manufacturing to avoid more expensive shipping costs. This will result in a fundamental downward spiral for shipping companies, and will incentivize a more rapid adoption of additive manufacturing processes than would be the case without this shipping cost dynamic.

Widespread Effects

Additive manufacturing will reshape the cost and supply chain dynamics of most industries that build and sell things. If 3D printing ultimately results in a decline of global trade volume, the effects become far more widespread, fundamentally altering shipping, logistics, manufacturers, retailers, job creation, and international trade.

Widespread adoption of 3D printing will generally be positive for developed economies as they transition from global to more local supply chains. Manufacturing and retail companies within those economies will be more capital efficient. Trade balances will shift in favor of fewer foreign imports. New jobs will be created to support additive manufacturing facilities. These will not be traditional manufacturing jobs, nor will they be created at a high enough volume to entirely replace prior manufacturing job losses. Nonetheless, this will result in more jobs in the manufacturing sector in developed economies.

Conversely, the widespread adoption of 3D printing will generally be negative for those countries that previously manufactured goods that would now be produced in developed countries, nearer to the point of sale. The requirement to manufacture some categories of goods in low-cost manufacturing areas will cease to exist, or be drastically reduced. Some developing economies will be able to shift focus towards other forms of primary activity but others will not, and the competition for remaining low-end manufacturing activity will increase.

Companies who build and sell things that can be 3D printed in part or in whole will benefit from cheaper manufacturing costs; those who move things and provide logistics capacity will be negatively impacted. Shipping companies specifically will face significant challenges unless the decreases in aggregate shipping demand are replaced with other items needing transport. Infrastructure and construction companies will benefit from different material construction techniques, as will aerospace companies and vehicle manufacturers.

Other Implications

Additive manufacturing will increase the relative value of things that cannot be 3D printed. We have seen a remarkable decrease in the cost of easily manufactured goods and commodities in recent decades, and this will accelerate with the widespread adoption of additive manufacturing technologies. In a world of increasing abundance, it is not difficult to imagine handmade goods and services being more highly valued and driving corresponding price premiums.

Another consideration is the general global security implication of a changing world economic structure. Countries have traditionally developed by starting with low-end manufacturing, then using that expertise and capability to move up the value chain into higher value-added manufacturing and services. Removing the first rung on the ladder could be disastrous to developing economies, making them net losers in the newly emerging economic structure.

Unless other categories of technology or economic activity emerge to replace these economic losses, those countries face a disaster scenario in which they would remain poor forever. Such countries would be firmly revisionist, incentivized to disrupt the system that has left them behind. This could manifest in many ways, including violent challenges to the establishment, creating security challenges for all countries.

Join the Catalyst Monitor

Join our community, where we push out regular insights to help maintain situational awareness on technological and socioeconomic trends.