Stress, Response, and Resiliency

The underlying structure of global markets changes over time. Sometimes this change happens quickly, other times it happens more slowly. There is always a reason or impetus for change. Sometimes this impetus is a “black swan” event; other times it is a more gradual change in some underlying dynamic. These dynamics are often understandable, and sometimes predictable, especially in hindsight.

Structural shifts in global markets matter for businesses and public institutions. They change what needs to be built, what people want to buy, and how people live their lives — all factors that drive the success or failure of businesses and public institutions that service these requirements. Understanding these structural shifts and, importantly, what to do as a result of them is crucial for leaders of these organizations. In fact, this is arguably the most important task for leaders of mature organizations.

Businesses tend to go through cycles of stress and response that lead to adaptation and growth. Stresses can manifest as new technologies, changing customer preferences, competitors, regulatory issues, or any number of items that compel businesses to react. The point is that things happen and businesses adapt, or they stagnate and decline.

The same structural shift often compels entirely different responses in different industries. At Grayline, we study the catalysts that drive structural shifts to global markets – a perspective that becomes truly useful, even critical, in context of industry-specific constraints, decision options, and strategic imperatives that organizations operate under.

We are initially focused on several core industries based on a mix of expertise, relevance, and client demand (aerospace, defense, energy, transportation, logistics, infrastructure, construction, and consumer products). However, we are in the process of expanding our aperture and coverage model into new industries. The following thumbnails, which are our initial thoughts on other key industries, is not intended to be comprehensive, as we are exploring and gathering data and expertise on these and dozens of other interesting industries and sub-industries.

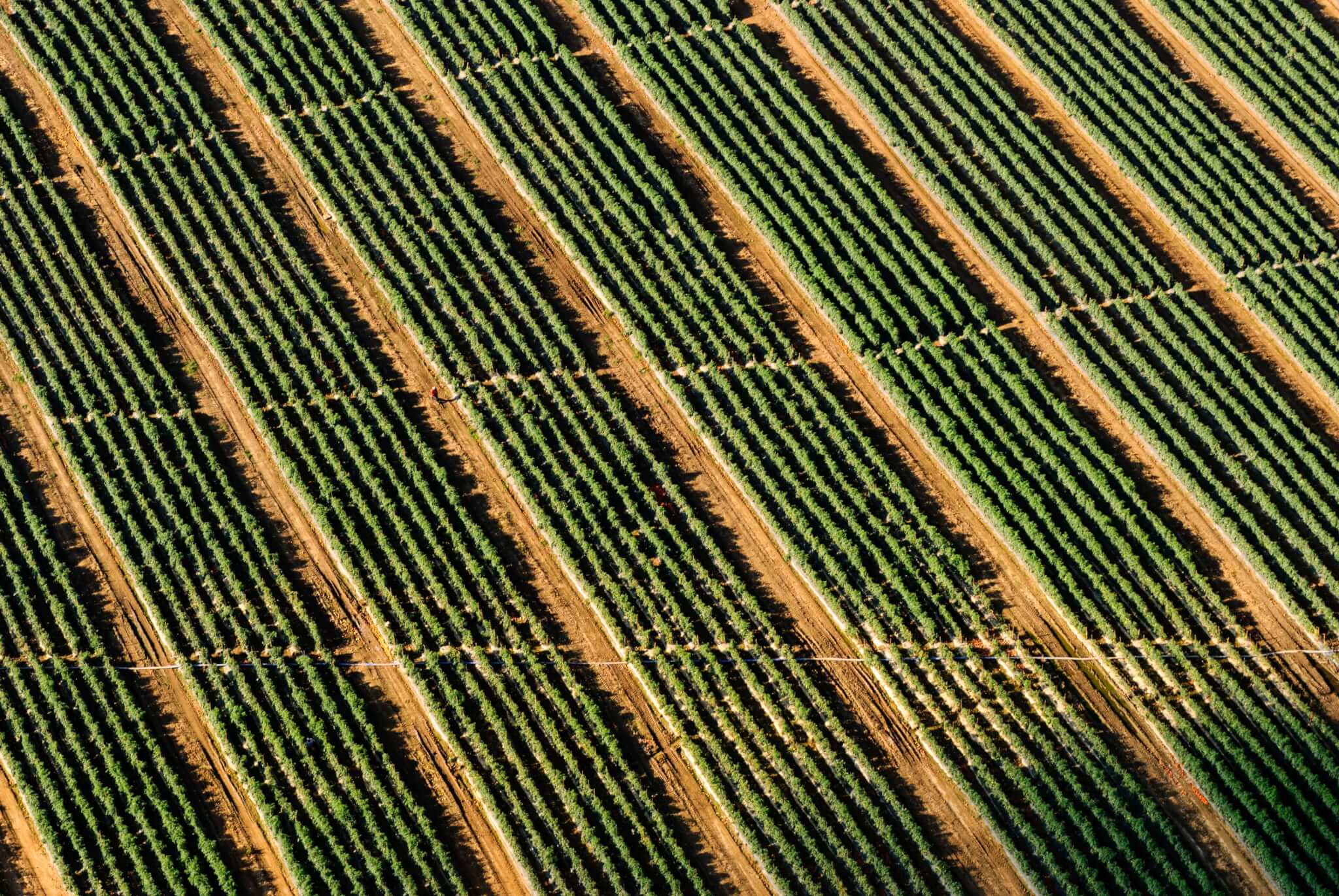

Agriculture

Agriculture is an incredibly important and interconnected global industry. Food, energy, water, and security are basic human needs and are at the core of the social contract between people and their governments. As such, agriculture is an element of national security, especially for countries with challenges and external dependencies in the agricultural sector. The drive towards efficiency and lower prices has resulted in a complex and interconnected system, where nations depend on other nations for parts of their food supply chain. In many cases the external dependencies are luxury items (i.e., strawberries in the winter), but in other cases they include core food staples (i.e., grain).

While agriculture is sometimes not viewed as a high-technology sector in the developed world, this is increasingly becoming a reality. Internet-of-things (IoT) technologies allow for sensors and micronutrient delivery systems that manage crops on a meter-by-meter basis. Drone technologies allow autonomous monitoring of large fields, focusing the efforts of farmers. Robotics and autonomous vehicles are converging, allowing the unmanned operation of large agricultural equipment.

These technologies all serve to increase per-acre yields and, in many cases, reduce the human labor requirements for the agricultural sector. It is possible that the developed world is on the cusp of another agricultural “revolution” drastically increasing capacity and output. In addition to disrupting the agricultural sector directly, step-function growth in this area will flow through to impact many other industrial sectors in a variety of ways.

Telecommunications

The telecommunications industry shares commonalities with infrastructure and consumer products, but faces a number of unique challenges specific to the industry. Many of the key capital assets for telecommunications companies are ultimately elements of national infrastructure, but these projects are generally not government sponsored or funded, as is often the case with large physical infrastructure. Communications tower, cable, and satellite networks are incredibly complex and expensive and take a long time to build. These companies face the common problem of having to build products and infrastructure for future markets, whose shape and constitution they can estimate but never perfectly forecast.

In addition to building infrastructure, telecommunications companies have the challenge of being consumer products companies in a fast-moving industry. They must be responsive to rapid changes in technology, customer preferences, and customer purchasing power, while balancing complex supply chains and product-development cycles.

Finance

Finance is an interesting industry to consider, because it is both a discrete industry and the backbone for every other industry in free-market developed economies. Finance can be evaluated in context of the underlying principles of the industry it supports. Understanding the energy industry, for example, allows us to understand the imperatives of investors in the energy space. The risk profiles may be different across the business cycle for operators and investors, but the underlying structures are the same.

This principle falls apart for investors in foreign exchange markets (FX), sovereign debt, and some of the more abstract financial markets, in which case finance must be studied as a discrete industry. We at Grayline are less focused on the specific mechanics of abstract investments than we are the underlying catalysts that change global market structures. We understand that these catalysts deeply matter to investors and are exploring connections between catalysts and markets.

Professional Services

Professional services is a broad category that includes the ecosystems of companies and public sector groups that enable systems to run. This includes doctors, lawyers, accountants, consultants, technologists, engineers, financial managers, and a variety of other functions. These companies are important because they represent cross-industry expertise that is critical to helping industries understand, plan, and adapt to major systemic changes.

As a category, professional services companies are reasonably agile and able to adapt in real time to changing environmental structures, but they also depend on the industries they support. This category includes many different types of companies, making it difficult to generalize impact and agility. On the one hand, there are focused companies entrenched in very specific technologies and industries, which can be utterly destroyed by large market shifts. On the other hand, there are broadly distributed services companies that perform functions that will thrive regardless of the extent of market disruption.

Public Sector

The public sector is not an industry, of course, but it is a fundamental element of our world view and thought process. Catalysts impact public entities just as they impact businesses, compelling public officials to adapt to ensure the continued success of their constituencies. Municipal, city, state, national, and international leaders are often on the front lines of these structural changes, but they operate in very different environments than business leaders, with unique challenges, constraints, and strategic options.

Our approach is to develop municipal, regional, cabinet, and state-level expertise under a general public sector umbrella to evaluate the important nuances that are unique to different types of public sector organizations in different parts of the world. Governments are critical components in the system, and as engaged citizens we are highly motivated to help civic leaders understand and plan for impending change.

Connections Between Industries

The intersection of industries is also important to understand, as these markets are connected. Infrastructure is a factor in where people live, which impacts what they eat and buy. This, in turn, drives how much power they consume and how they consume it. We could continue this logic chain ad infinitum. Suffice it to say that there are no independent variables here. Everything must be understood in context of everything else.

Connectedness provides for efficiency and scale but also adds risk and, to borrow a phrase from Nassim Taleb, fragility. The butterfly effect, explored in mathematics and chaos theory, also applies to industries because of these deep economic connections. When connections are global, as opposed to local or national, disruptive events can have an outsized and cascading impact.

Thus it is important to evaluate industries in context of the global system, just as it is important to evaluate companies in context of industry systems. The best company strategy can implode as a result of a change to another, tangentially related industry. Making decisions within interconnected and complex systems is a challenge for executives and public officials, to be sure. Risks (and opportunities) abound, which makes this a fascinating time to live and work.

Join the Catalyst Monitor

Join our community, where we push out regular insights to help maintain situational awareness on technological and socioeconomic trends.