Jobs vs Automation – Where Did They Really Go?

Back in November, Fortune published an article entitled “Don’t Blame China for Taking U.S. Jobs”. The core premise of the article is that it is automation that is taking US blue-collar jobs, not China (and, by extension, NAFTA countries or other Low Cost Countries, aka LCCs in industry parlance).

The premise of the article did not fit the facts as I know them in the industry. I know a bit about factory automation in general and robotics in particular (you can read my MS thesis on robot design if you’re ever at the UT-Austin main campus and terminally bored, a highly unlikely combination of events in Austin!). I also cofounded a factory automation company, and in my last industry position, among many other hats I was responsible for global robotics and automation strategy for a Fortune 500 company with plants all over the globe. So, where did the article go wrong?

The original study the Fortune article is based on is from Ball State’s economics department. Their analysis was very simple, which makes it easy to understand and thus compelling to the average reader. Yet this is also its fundamental flaw. All they did was look at US productivity and GDP growth vs employment. On the surface, this makes sense, right? Well, not if you really understand the complexity of the problem. While I have studied other industries enough to know that the analogy I am about to present also holds true for those industries, I’ll keep this analogy simple and constrained to one specific industry example to hopefully make this analysis as compelling as the original article.

Let’s use a typical red-blooded, all-American full-size truck, say a GM product like the Chevy Silverado, as an example. Similar discussions can be had around many vehicles theoretically made in the USA by ALL automakers, regardless of national origin, so don’t get the mistaken impression that only GM does this.

First, you need to understand how GDP is calculated. (You don’t have to read the entire 25-page document explaining it from the US Commerce Department. All you need to understand is the very simple representation of what is measured and what is not measured on page 7, section 4.) In short, only the FINAL consumer product’s value is measured as a GDP contribution. Any parts or components that come in from elsewhere are NOT counted separately.

The GM full-size (FS) trucks are produced at two plants here in the US and at one in Mexico. For the GM FS trucks assembled in Flint and Ft. Wayne, the entire truck’s sticker price counts as a GDP manufactured good contribution under Commerce Department guidelines, and the employment count Ball State used captures the people at the assembly and supplier plants LOCATED WITHIN THE US. What CANNOT be counted is the employment at GM and GM supplier plants in LCCs, primarily Mexico, but also China for some components that go into these trucks.

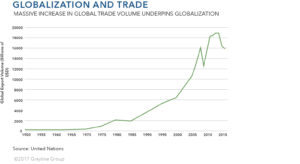

The two most complex components, the engine and transmission, come from GM’s Mexico plants, which they have been expanding aggressively in recent years. Dig around a bit, and you’ll see that this expansion has been ongoing and accelerating since NAFTA. Pre-NAFTA, Mexico made 3% of the cars and trucks sold on the North American continent; now they make 20% plus a substantial chunk of the major components that make up the rest. The single largest component on the truck, the frame, also comes from Mexico. If you see a freight train rolling through Texas headed North, odds are it has rail car after rail car of truck frames on it. So, even though a substantial part of the value of the truck comes from Mexico, along with the jobs that create that value, the Ball State methodology still counts the truck’s full value as US manufactured.

The catch is clearly that most, if not all, of that labor-intensive engine and transmission assembly takes place in Mexico, labor content that is completely missed by the Ball State methodology because of how GDP contributions are calculated. To sum it up, a high-level look at manufactured goods value vs manufacturing employment totally misses LCC’s parts-labor content and makes it look like all those jobs are going to automation! As a guy who understands robotics from both the inside and the business side not to mention global supply chains, I can tell you that a large portion of those jobs were not lost to automation.

It’s important to look beyond statistics to understand how and when jobs are displaced by technology, business process innovation, or outsourcing to low cost countries.

Join the Catalyst Monitor

Join our community, where we push out regular insights to help maintain situational awareness on technological and socioeconomic trends.