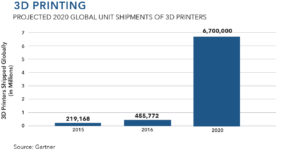

Implications of 3D Printing

Additive manufacturing (AM), or 3D printing, provides a number of productivity and supply-chain efficiencies that companies and investors will ultimately realize by incorporating these technologies into their manufacturing processes. Every industry will have specific types of efficiency gains, and our intent here is not to list all the different industry-specific AM applications. Instead we would like to highlight some of the structural shifts and new ways of thinking that we believe will be enabled by AM technologies in the near future.

At the most basic level, AM technologies enable customization at scale, which facilitates new design paradigms and stands to improve the consumer product experience immensely. If companies no longer have to mass-produce identical items at scale in order to drive down costs, unique products will become economically competitive for the first time since the small-town tailor and craftsman. Companies are and will be able to manufacture apparel and accessories using these technologies, providing a wider range of customization and personalization. This could manifest as individualized designs or custom-fitted artifacts for an individual’s unique measurements, both of which could be produced at scale using AM technologies.

In fact, we are already seeing consumer products companies using 3D printing in limited applications for niche goods such as custom jewelry and high-end sporting goods. A 3D-printed jacket was introduced in 2017 by Israeli designer Danit Peleg and marketed as “the first 3D-printed garment ever sold online.” We are on the cusp of a new explosion in creativity, with companies being able to customize fashion, furniture, housing, and other basic goods directly to the consumer’s needs and best fit. This is not a one-off custom system, per se, but rather represents customization at scale—including individuals directly designing and manufacturing goods themselves.

When we apply the principal of customization at scale to the individual, we also anticipate the revival of the craftsman, or craftsperson. A 3D printer is relatively inexpensive, hardware-wise, and the software required to run it—CAD, AutoDesk—is highly accessible and has been used by engineers for years. Think back to the 1980s when home computers made it possible for a whole new generation to learn ways to creatively program their own software tools and games. The designers and coders who unleashed multi-billion-dollar companies started as teenagers with their home computers. Imagine what we might do in our economy when 3D printing in the home unleashes a new generation of inventors and designers. The innovation and entrepreneurial energy that has been applied to software development can be translated into physical goods at scale via AM technologies.

Just-in-Time vs. On-Demand Inventory Management

AM will also enable more efficient “just-in-time” inventory management processes, as opposed to traditional warehousing and distribution systems. This will drive a significant evolution in the businesses, systems, and technologies that support the supply chain and manufacturing processes for all companies that build and/or sell physical products. There is an entire sector built around inventory management and anticipating what organizations may need at a given time. AM allows more and more manufacturing to be conducted in-house, and it decreases the cost variance between small and large production runs.

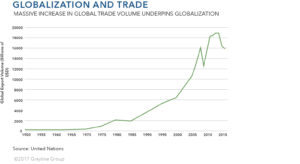

Simply stated, the current common practice for many American companies is to design an item, have tens of thousands of them manufactured in China, ship them to the United States, and warehouse them until they sell them. In the current subtractive manufacturing environment, both manufacturing and shipping costs go up significantly if you order smaller production runs, and it takes time to ship them from China to the United States. AM could shift this dynamic by enabling some types of goods to be produced on demand, when needed, and at the same cost as a large production run. This would be significant to the companies and real estate investors that support warehousing, and could enable the growth of new types of inventory-management companies and products.

Shipping and Logistics

In addition to the impacts of AM on globalization, it is important to reflect specifically on what this means for the shipping and logistics industry, as many other types of companies rely on this industry. Manufactured goods make up 15 to 25 percent of total global shipping volume, and some percentage of those manufactured goods could be fabricated closer to the end customer. It stands to reason that shipping demand will decrease as a result of AM. Locally produced renewable energy will have a similar effect on decreasing shipping demand. As the shipping industry operates at a high fixed-to-variable cost ratio, even a marginal decrease in volume could have a magnified effect.

Shipping is a capital-intensive industry, and large cargo ships are expensive. The cost for the ship is spread across each item it transports. Currently, the cost to ship an item is historically inexpensive, in part because the volume of items shipped is high. If the industry suffers a major decrease in demand, it will lead to overcapacity, and shipping costs will rise because the same (fixed) costs of the ships will be spread over a smaller base of items shipped. Higher prices could cause other companies to search for local solutions, which could create a slippery-slope effect that would severely constrain these businesses.

Let us consider a recent event to illustrate the point that financial difficulties within the shipping and logistics industry can have far-reaching impacts. In February 2017, the Hanjin shipping company out of Korea officially declared bankruptcy. A few months earlier, Hanjin ships had been stuck outside the Los Angeles and Long Beach ports, not allowed to dock because no one would underwrite the costs that the shipping company owed but could not pay. The ports essentially used the shipped merchandise as collateral that might recover some of what they were owed. While the shipping company scrambled to find a solution, major American retail companies felt the crunch as their expected products sat on the ocean instead of making their way to distribution centers. Some eighty to ninety vessels worldwide were affected, holding 500,000 containers that represented $14 billion in merchandise. These transformations have far-reaching consequences, and we no longer have the luxury of focusing on the dynamics of only our own industries.

Rise of the Craftsman

Another interesting consequence of additive manufacturing is the likely increase of the relative value of things that cannot be 3D printed. In recent decades, we have witnessed a remarkable decrease in the cost of easily manufactured goods and commodities. This will accelerate with the widespread adoption of additive manufacturing technologies. In a world of increasing abundance, it is not difficult to imagine handmade goods and services being more highly valued and driving corresponding price premiums.

Join the Catalyst Monitor

Join our community, where we push out regular insights to help maintain situational awareness on technological and socioeconomic trends.