Direct vs. Ecosystem Investments

Cryptocurrencies have been on a tear, growing from USD 20 billion to over USD 600 billion in the past 12 months. From its cypherpunk genesis, these new systems have gone from obscurity to the hottest thing around in record time. Mainstream players are beginning to realize that ignoring the emergence of these systems may no longer be an option.

I like blockchains, but not cryptocurrencies.

As mainstream folks start to pay attention, they often fall into the camp of seeing value in blockchain as a technology but not the underlying cryptocurrencies. They then take action on this perception in two forms. The first is to get excited about projects that use the underlying technology but strip out cryptocurrencies. In effect, such projects seek to leverage distributed ledgers as enabled by blockchains to redesign an existing system in order to improve speed and efficiency. Further,

Speed and efficiency are not the only qualities that make distributed ledgers attractive to banks. ‘Regulators will like that blockchain-based transactions can achieve greater transparency and traceability– an “immutable audit trail”,’ [Blythe] Masters [of Digital Asset Holdings] says. In other words, it could help eliminate the kinds of fraud that come from cooking the books. – Rachel Botsman in Wired, December 27, 2017

In this form, Ms. Masters and other builders of “cryptocurrency-free” blockchains are building a new type of database. Speed, efficiency, even auditability characteristics can be delivered by modern database technology.

Cost too is a factor; blockchain technology is significantly more expensive to build and operate than current database options. The redundancy alone that decentralized systems provide increases costs in multiples if not by an order of magnitude or more. Can “speed and efficiency” and “auditability” prove enough benefit to overcome such costs?

The fundamental innovation of these emerging systems is the ability for the protocol to incentivize the actors of the system to act in the system’s best interest regardless of context or intent. The crux of these incentives is the underlying cryptocurrency. Without the cryptocurrency, the incentives lack value. Without value, the system ceases to function in the same form. The technology has (so far) allowed for “distributed trust” among system participants at a scale no database or other prior technology has been able to deliver, in effect enabling permissionless participation in the system. The increased costs of building, operating and maintaining such a system as compared to modern databases have been overcome with flair.

In banking, implementing a blockchain without a cryptocurrency is more aligned with the traditional Medici-style banking system for value transfer. For such blockchains, actors must adhere to the standards of the gatekeeper(s). In effect, the incentives to ensure trust within the system exist outside the protocol, but within the people and organizations that maintain it. Such systems ignore the incentive structure that underlies cryptocurrency-based blockchains, the core innovation Bitcoin has so far proven valuable.

If participants are comfortable maintaining incentives outside the protocol, why not anoint an organization to maintain the data as well, negating the need for a distributed ledger?

Ok, what about “picks and shovels?”

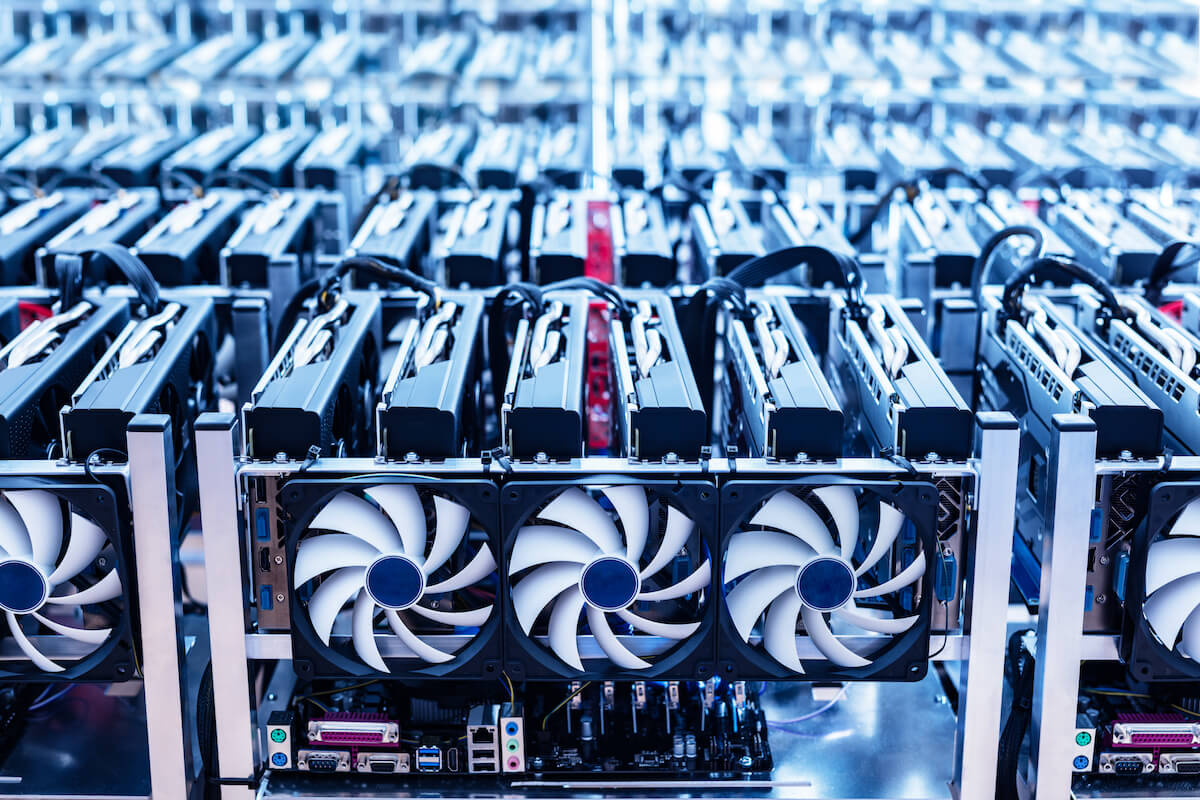

The second path that excites many to take action towards “blockchains but not cryptocurrencies” is to focus on “picks and shovels” – the ancillary services, tools and resources needed to support an emerging cryptocurrency ecosystem. Opportunities exist to make traditional investments in companies that are operating in and around cryptocurrencies, providing exposure to the assets without the need to hold them directly. Significant capital is needed to build out the ecosystem. However, two key risks are inherent in such plays but mitigated by holding cryptocurrency assets directly: capital lockup and geographic concentration.

Making a traditional venture capital investment into a company requires a capital lock up period of years. Making an investment in the underlying cryptocurrency(ies) does not require such lockups. At worst, capital is locked up for a few months if allocated to a pre-market ICO and/or market liquidity hinders moving in or out of the opportunity. Also, as the broader cryptocurrency market expands, the latter hindrance is lessening by the day as liquidity improves.

Another risk to the traditional investment is to understand the geographic risk. At best, an early-stage startup has operations in one or two locations. Public cryptocurrency-based blockchains are inherently global, untethered to any one location. Teams building and operating these systems are located all over the world, with little geographic concentration even within projects.

As the broader cryptocurrency market continues to develop, it is expected that local regulatory and other entities will get involved; some may choose to take an aggressive stance towards the ecosystem and its supporting actors. If your investments are concentrated in any of these less-welcoming geographies, they can become threatened. This risk is only heightened as these emerging systems threaten existing systems.

Now what?

The decision to invest in cryptocurrencies, once made, is the easy part. Regulatory bodies are starting to engage. Adhering to the intent of current regulatory regimes can itself be a major effort given the rapidly shifting regulatory landscape. Couple that with the current infrastructure that has developed over decades to effectively govern strong, sound fiduciary management and just getting the greenlight to provide exposure to the cryptocurrency asset class is a feat itself for most any investment management firm.

Holding cryptocurrency assets is no simple matter either; the base concept is to allow the individual to control the asset. This brings with it a responsibility (and a risk) to maintain secure operations that few, if any, organizations in the world are capable of, to include investment firms or others. Few, if any, trusted third parties exist yet to support such needs, in particular given audit and other requirements institutional investment firms require. And those that do exist incur their own set of risks.

A final note: if you happen to lose the cryptographic key for your investment, it’s gone and entirely unrecoverable. Nobody wants to come to the realization that they just lost a mammoth investment in its entirety because they didn’t know what they were doing.

These challenges are not insurmountable; they require dedicated effort and expertise. Given the global access to an emerging asset class that last year returned 30x, now is the time to start building — just know what you’re jumping in to before you take the leap!

Join the Catalyst Monitor

Join our community, where we push out regular insights to help maintain situational awareness on technological and socioeconomic trends.