Insights

Research, analysis, and commentary on AI, cybersecurity, mobility, and the technologies reshaping complex industries.

Reimagining American Manufacturing: Meeting the Growing Global Threats

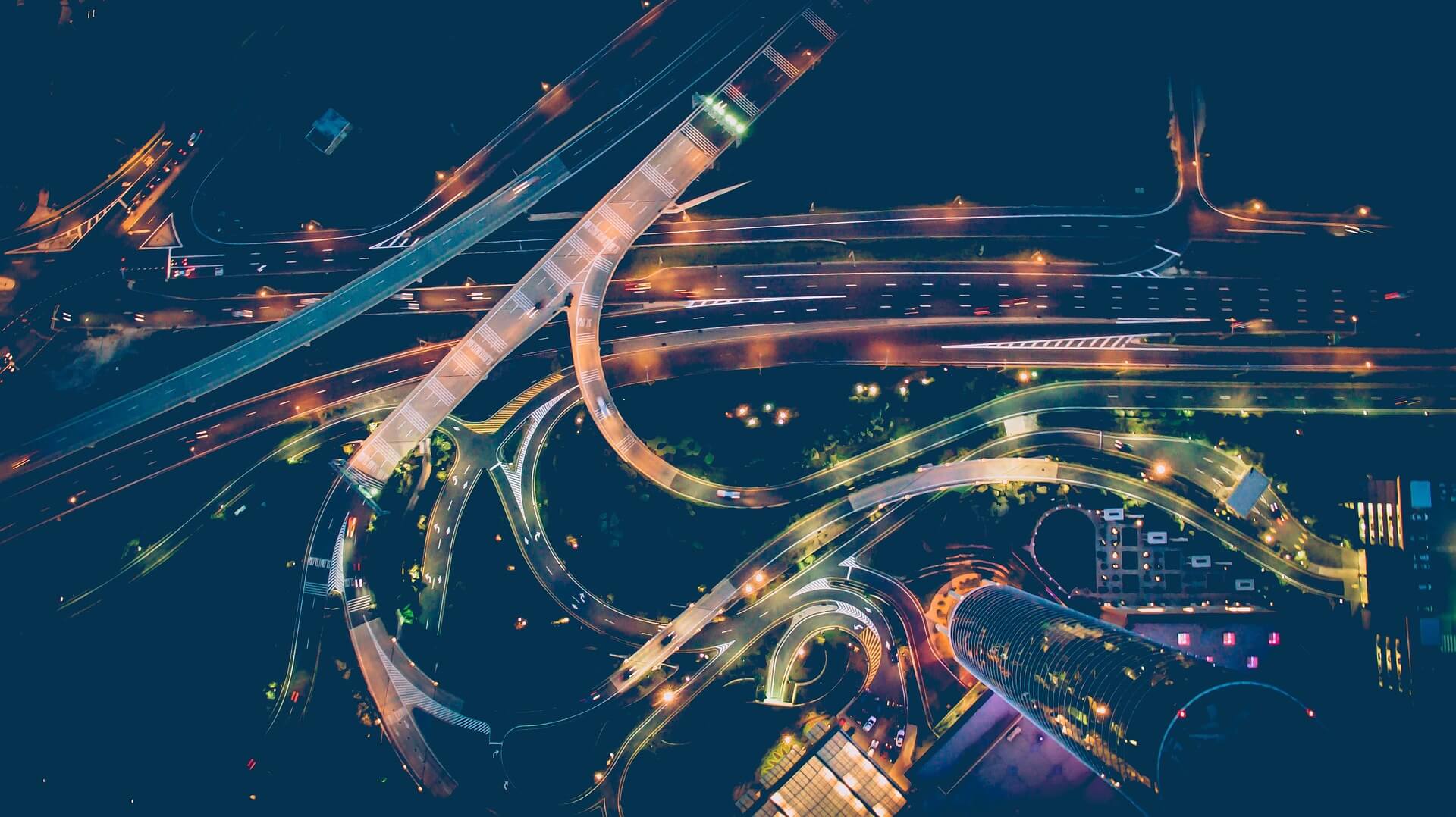

How AI Can Reshape Our Urban Future: A Deep Dive into Sustainable Development

The Unchanging Importance of Human Connection Amidst the AI Revolution

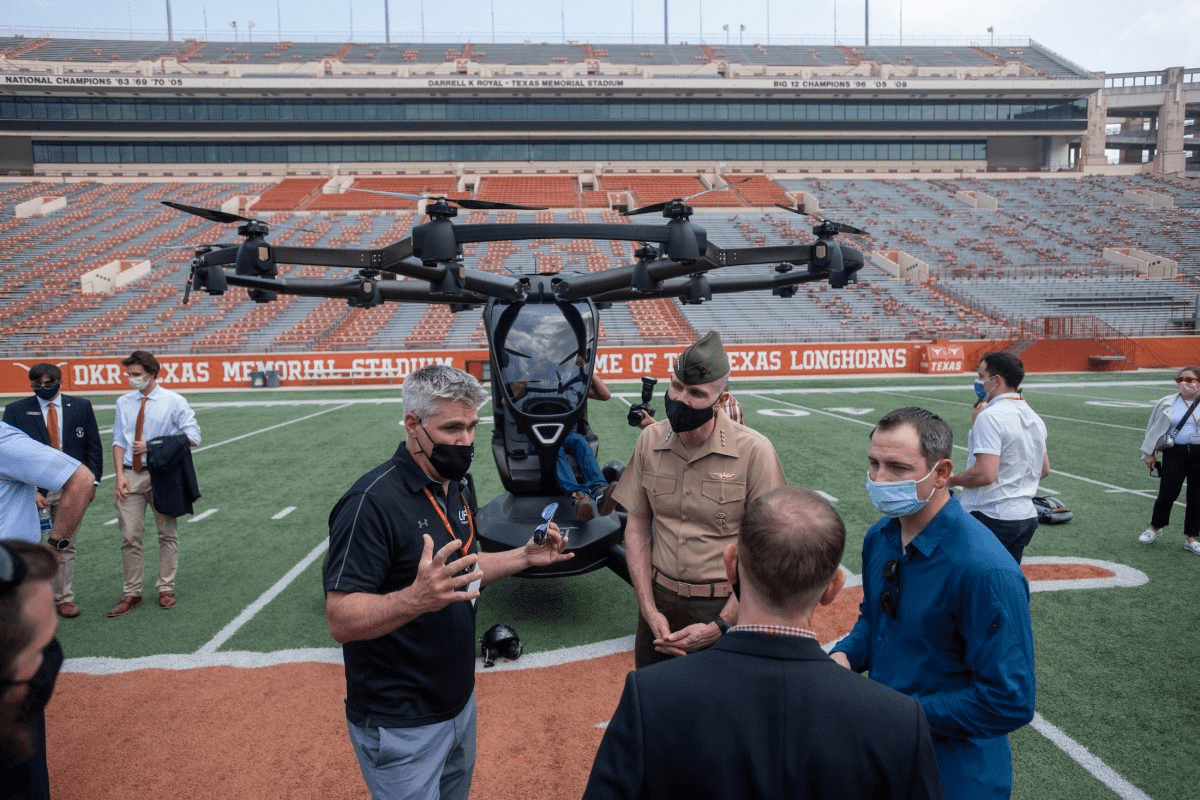

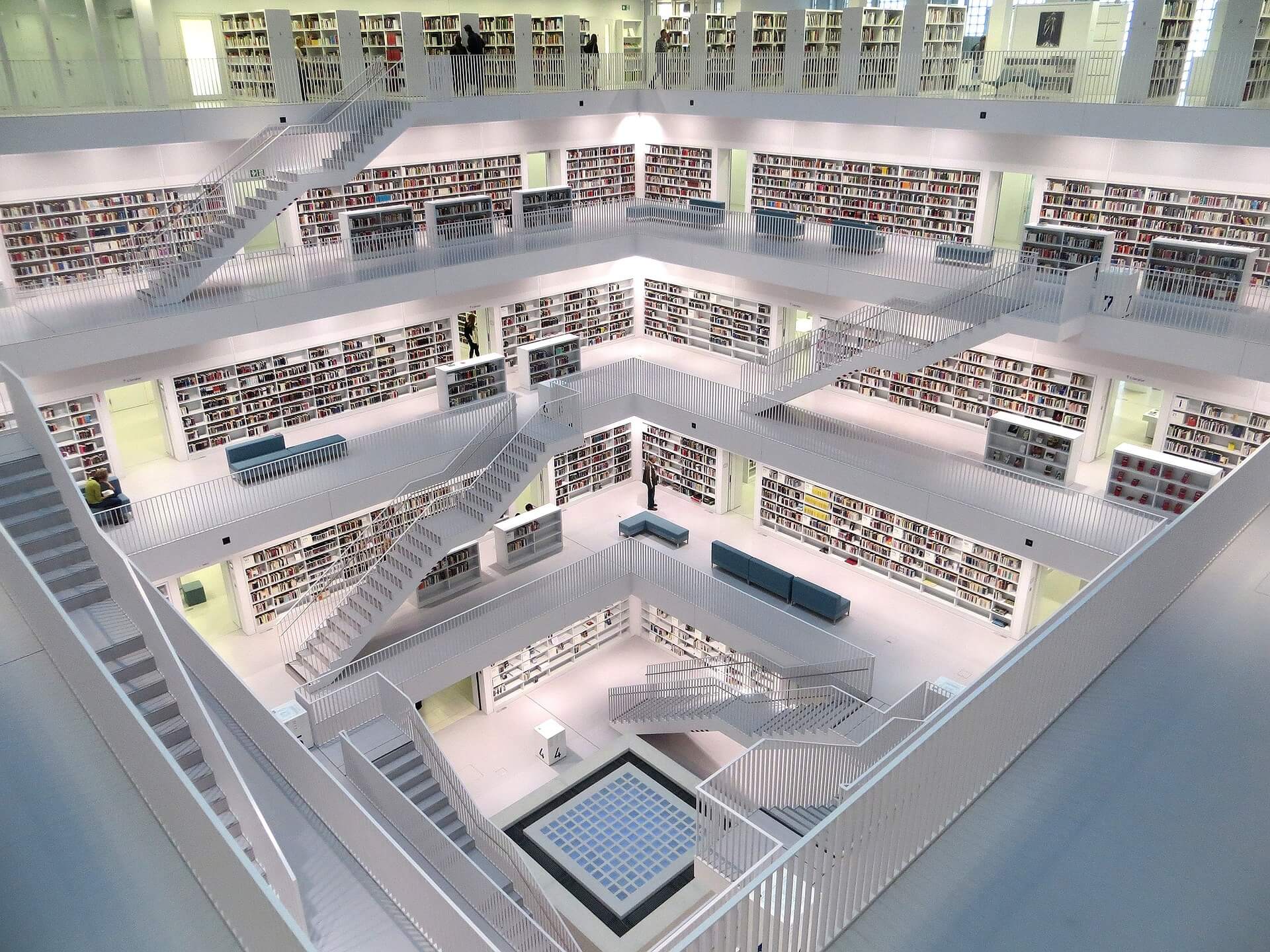

Innovating the Profession of Arms: Education for Defense Innovation

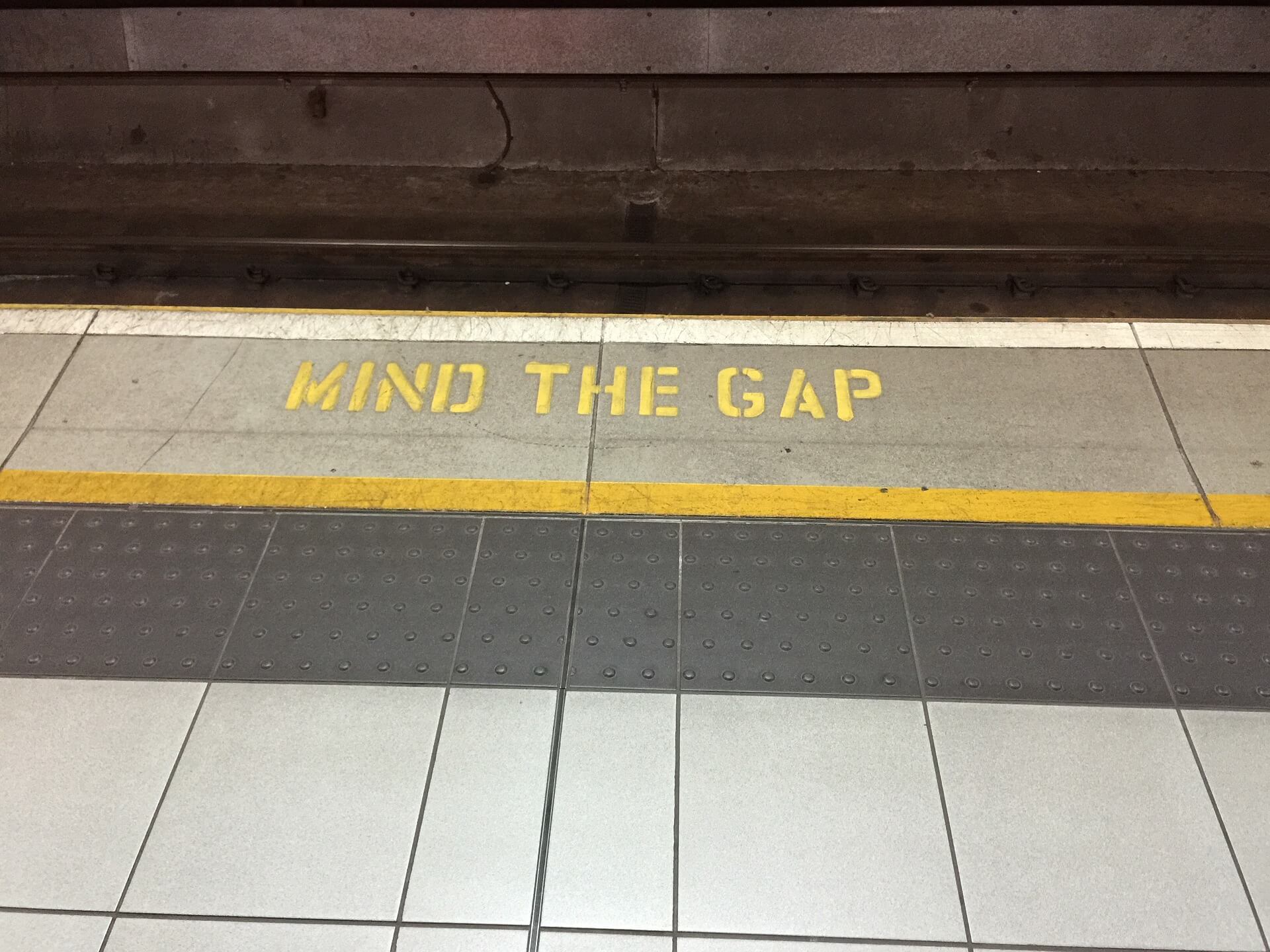

Cybersecurity Management: Driving Improved Resiliency in Public Transit and Beyond

ProjectReady: The Time To Prepare For The IIJA Is Now

What Flying Taxis Could Mean for Urban Transport Once They Take Off

Building the Education Infrastructure for a 21st Century Economy

Cybersecurity and Transportation: Is the Transit Industry Prepared?

The Growing Infrastructure of the Global Gaming Industry

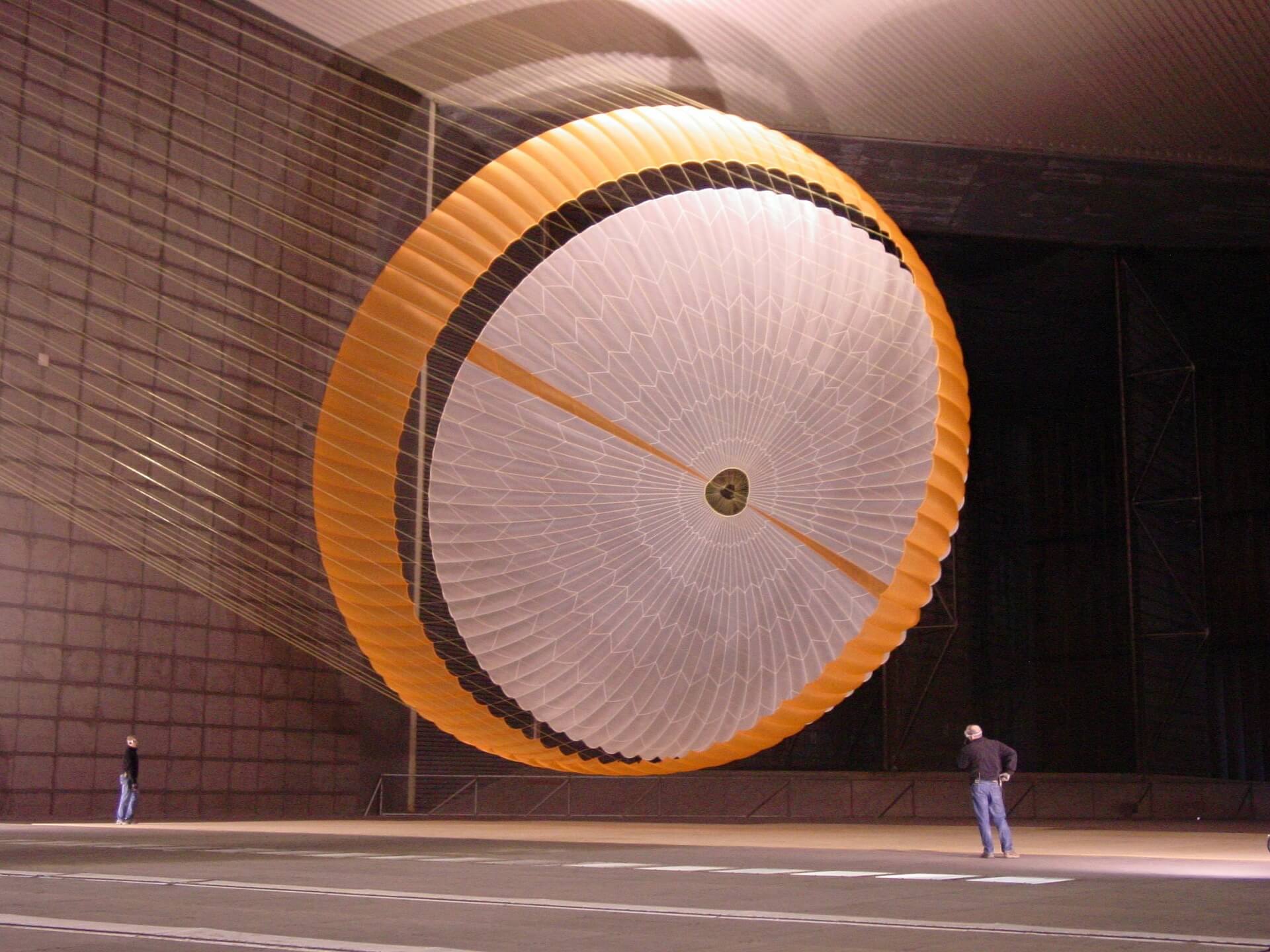

Building Infrastructure for the Space Industry with New Rocket Companies

Grayline Group

Defense Acquisition Reform is a National Security Issue

Augmented Humanity: The Future of Health and Performance

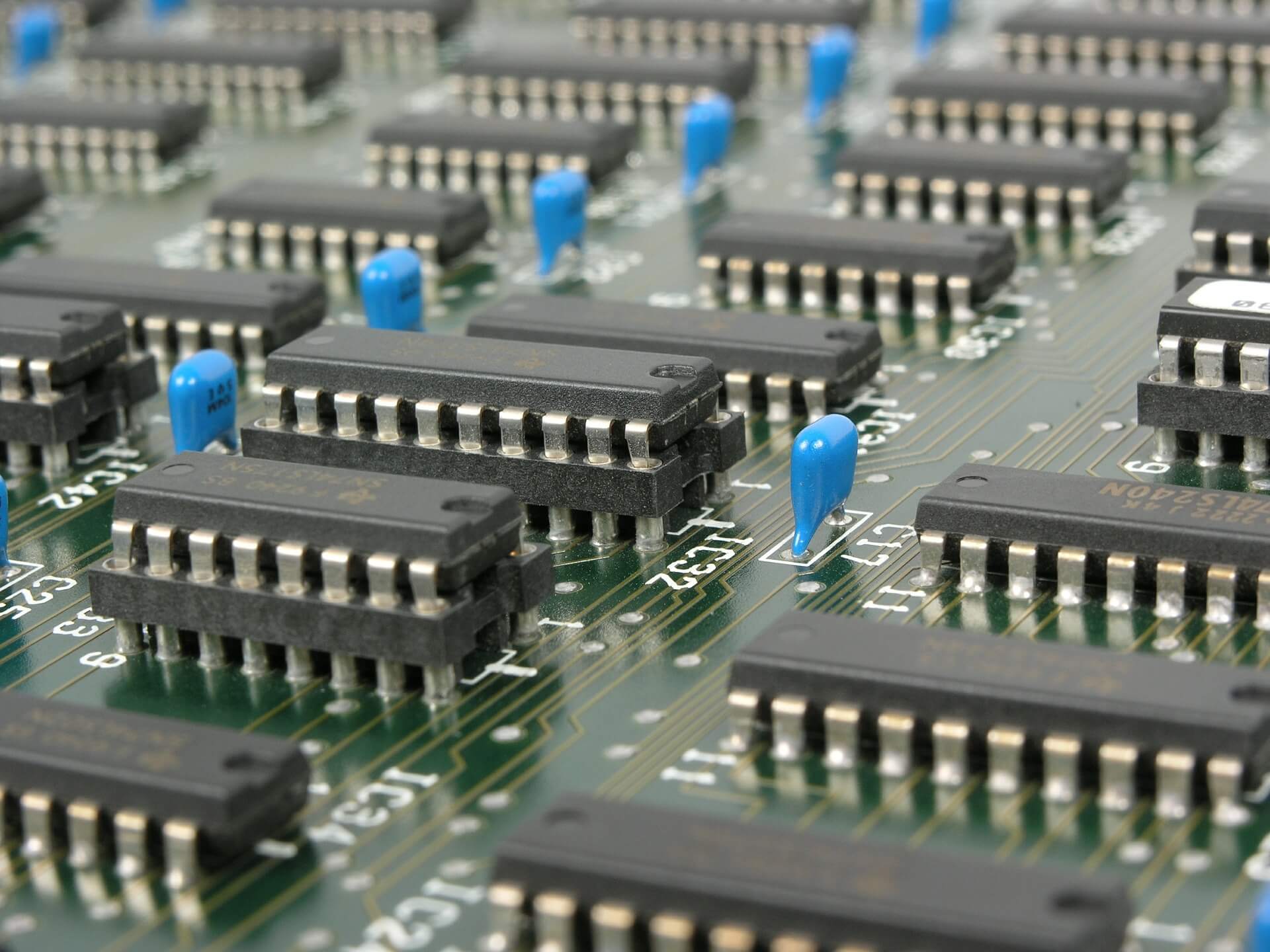

Microprocessors and Line Spacing: The End of an Era

Advanced Modeling and Simulation: Transforming the Ways We Understand How the World Works

Smart City Challenge: An Update on the Participating Cities

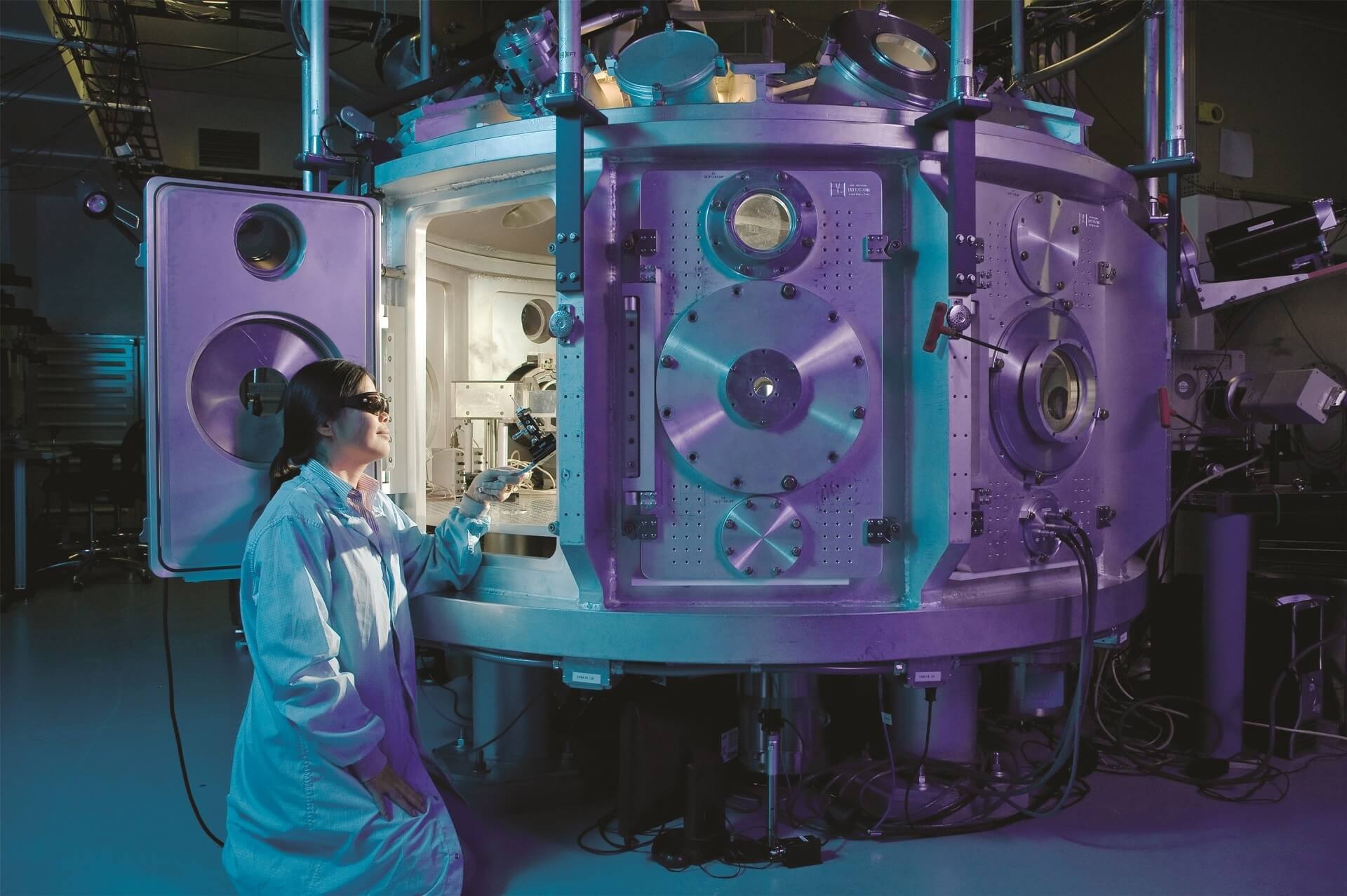

Quantum Mechanics and the Next Revolution in Computing

National Strategy for Energy Security: The Innovation Revolution

Intelligence, Surveillance, and Reconnaissance in Dense Urban Terrain

Developing Economies: Winners, Losers, and Those Left Behind

Power, Energy Storage, and the Decentralization of the Grid

Infrastructure and Construction: Building for Generations

Urbanization & Megacities: The Catalyst Reshaping Our World

How the mass migration to cities is transforming infrastructure, markets, and policy. Explore the forces driving urbanization and what megacities mean for business and government.

Grayline Publications

Catalyst: Leadership and Strategy in a Changing World

The foundational text behind Grayline's analytical framework — identifying the five structural forces reshaping the global economy.

Buy on Amazon

Chain Reaction: How Blockchain Will Transform the Developing World

A clear-eyed examination of blockchain's real implications for economic development — focused on genuine opportunities, not hype.

Buy on Amazon

You Can't Give What You Don't Have

A practical guide to personal leadership built on the principle that effective leadership starts with sustained personal investment in capability, character, and clarity of purpose.

Buy on AmazonGet Insights Delivered Weekly

Insights on AI, cybersecurity, mobility, and innovation delivered to your inbox.